We value your privacy!

We use cookies on our website to offer you the best experience. By clicking "accept & close", you agree to the use of all cookies according to our and our . If you do not make a selection, our default cookie settings will be applied. You can change your settings at any time.

Essential cookies: They are required for the proper functioning of the website. First-party- und third-party-cookies: They are optional and are set by us or our subcontractors. Session and persistent cookies: Are automatically deleted when the browser is closed. Persistent cookies are cookies that remain on your computer/device for a certain period of time after the browser is closed.

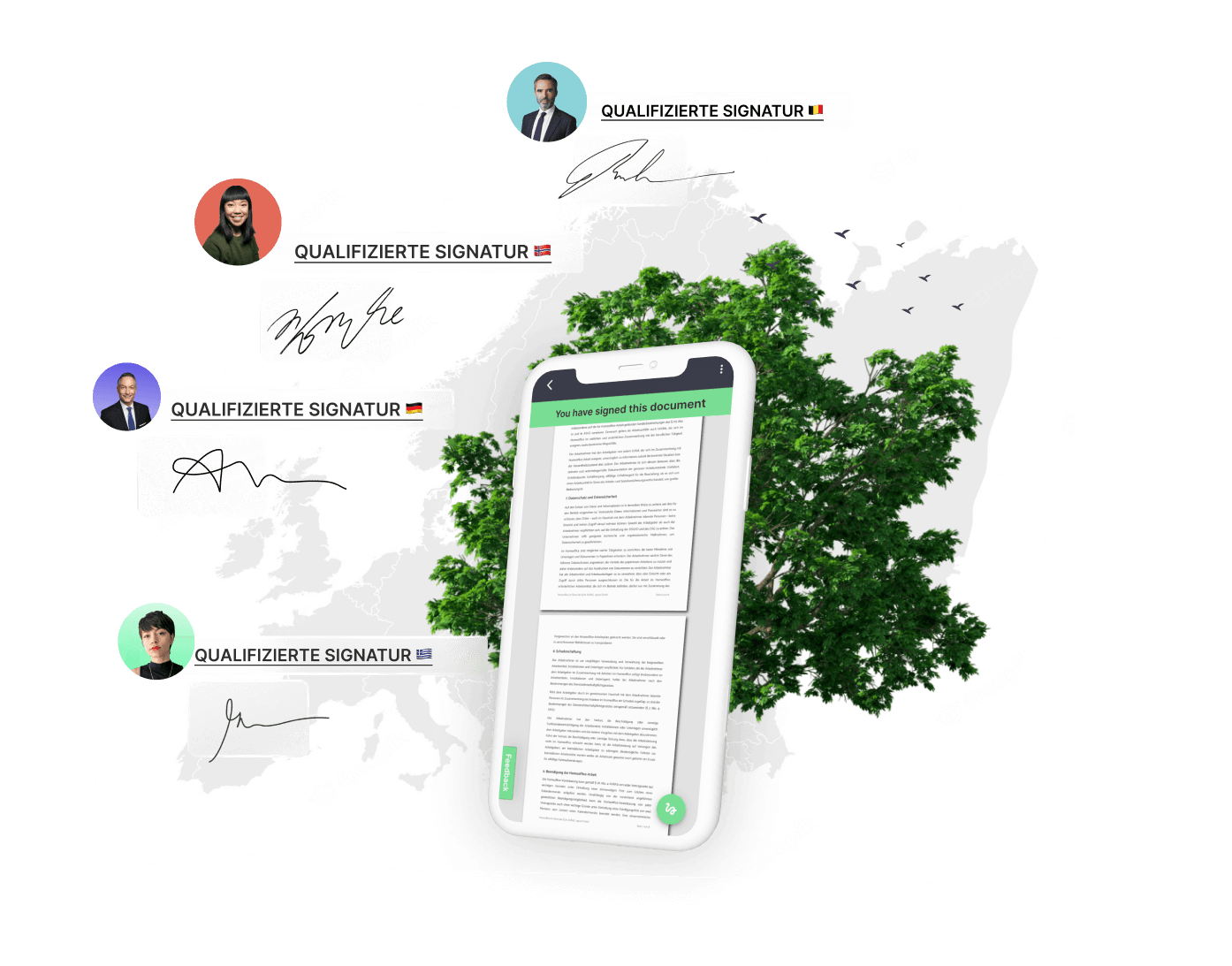

Digital Signature 2.0 - Qualified Signing without Borders throughout Europe

Updated on 13.10.2022

sproof aims to become the central interface for digital qualified signing throughout Europe.

The digital signature is here to stay.

When we talk about "digital signature 1.0" at sproof, we are referring in general to the digital collection and issuing of signatures. The benefits of an intelligent signature platform are already known to many entrepreneurs. The mapping of signature processes or "signature workflows" is making important contract or approval processes easier for more and more people, especially in the business environment. It doesn't matter whether internal signatures are used in a team or throughout the entire company, or whether external signatures, e.g. from customers, suppliers or clients, have to be obtained as a matter of priority: The digital signature has been able to place itself at the top of the list of successfully implemented digitization initiatives.

As is true for all "tools," the decision is only made to revamp established processes and adapt them to the times if the benefits can create immediate added value. Document signing is one of the oldest business processes, so one can imagine that many companies see a challenge when it comes to replacing traditional pen-on-paper signing.

However, it turns out that even people who like to make a decision by signing by hand, who are used to affixing a signature that has been cemented over the years and is full of art, appreciate the benefits of digital signatures.

Soberly considered, these advantages of the digital alternative to "paper & ink" have become too great. It can be shown by simple calculation that even with just a few signature processes performed on a regular basis, a digital workflow can make itself felt through significant savings in time and personnel resources. Of course, it can be attractive to sign off an important decision collectively on site by hand. But: Signing digitally means 1) Savings, instead of tedious preparation and mailing of documents 2) No waiting time for the returned, signed documents 3) Enormous savings in printing costs, mailing costs and paper costs.

The bottom line is that the arguments are overwhelming and only a few companies have not yet planned the introduction of a digital signature.

In addition to the process-related advantages and the savings in resources, many security-conscious entrepreneurs have also recognized another advantage of the digital signature: If you decide to use qualified digital signing (QES) of documents, you benefit throughout Europe from the fact that this type of signature is legally equivalent to a manual signature.

To do this, people must identify themselves with their passport or ID card and enter a confirmation code via their cell phone, for example. The signature is thus uniquely assigned to a person. However, the one-time identification cannot be done just anywhere, but must be carried out by a licensed trust service provider. Once you have identified yourself, you can then use various signature platforms (such as sproof) to sign qualified documents yourself.

sproof has deliberately positioned itself as a provider for companies in the European legal and data protection area. The user experience has been specially adapted to signing with the highest standard, qualified signing.

A new challenge for digital signature processes is on the horizon

The number of trust service providers has been growing rapidly for some time. For example, if I have to sign a document in a qualified manner for one company or customer and then later for another customer, it may be necessary for me to identify myself anew each time. While this process is not complicated, in practice it can be time-consuming and unnecessary if performed repeatedly.

sproof now offers a solution for this for the first time and allows existing identifications to be used directly. Thus, when a document is signed with sproof, there is no need to go through a new identification, but existing identifications, such as ID Austria, can be used directly.

"When analyzing the new problem, we consulted different solutions to the problem, some of which were very successful," says Clemens Brunner, CEO and co-founder of sproof. "We found an apt role model in Stripe's solution and very often drew comparisons to the company's business model when strategically planning our solution. Stripe's solution approach of creating a central platform for interoperable payment processes was a big game changer for thousands of web stores at the time." We found clear parallels in this success story to our solution approach for interoperable qualified signing in Europe.

Stripe was an inspiration in developing a "hub" for qualified digital signing.

The central interface for qualified signing in Europe was released as a beta test

The solution presented by sproof reinvents digital signing in Europe and makes it accessible to many people in a simple and low-threshold way for the first time. This was preceded by intensive development work, for which experts from the areas of UI/UX, software development and cryptography were involved in close cooperation.

"In business collaborations, signing documents can be a day to day headache. With the upcoming interface there are no barriers anymore and you can jointly sign contracts and break borders within the European Union."

Berthold Baurek-KarlicInvestor and CEO | Venionaire Capital

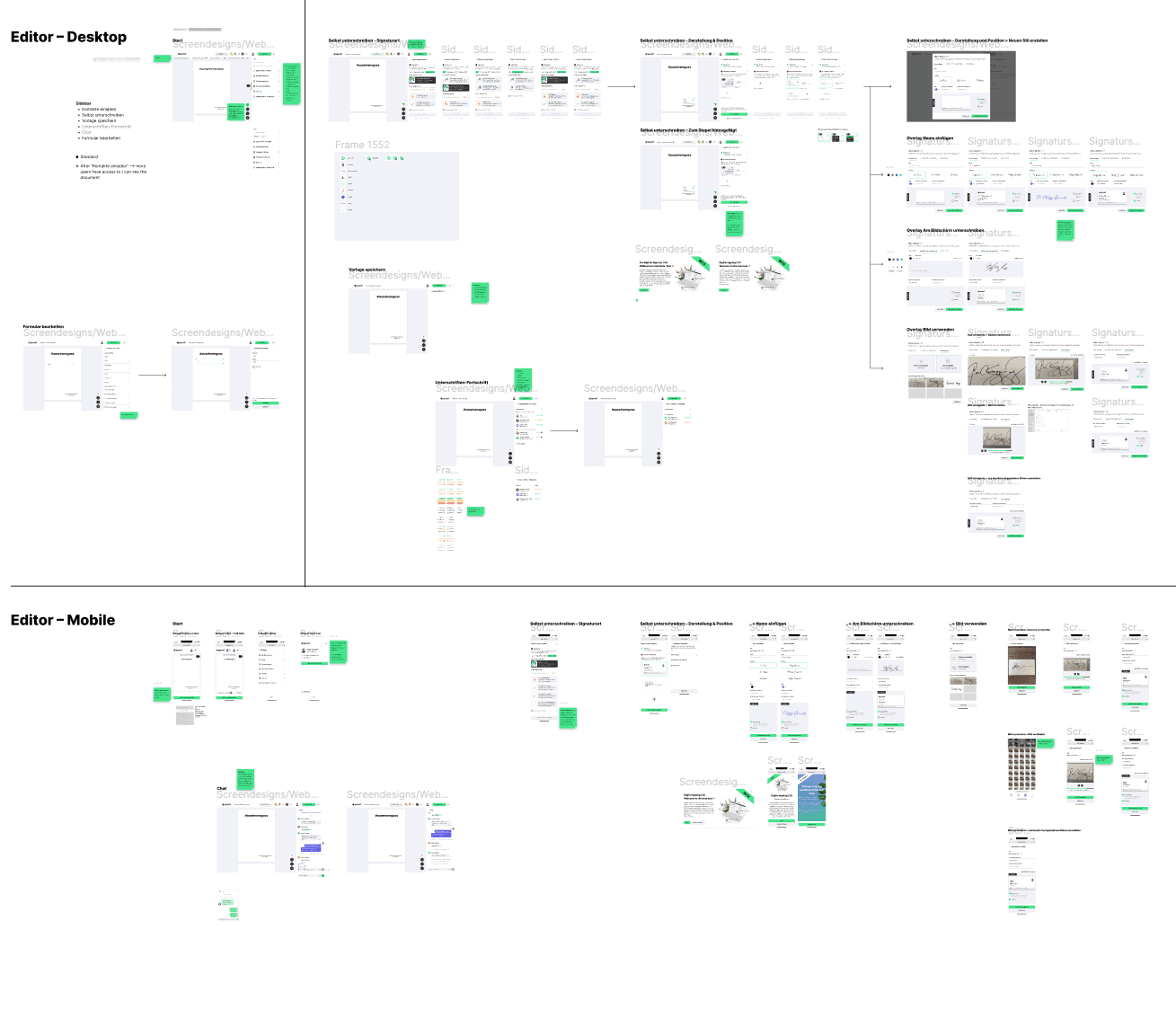

After the problem was identified and analyzed with the help of qualitative expert interviews, the next step was a design thinking process lasting several weeks, which resulted in a comprehensive design study.

Excerpt from the design thinking process for the newly developed prototype

The finished prototype was recently transferred to an official beta test phase with selected power:users, customers and investors. The goal of the beta phase is to intensively test the usability and the new workflow. At the same time, the list of integrated QES providers will be successively expanded. Ultimately, sproof, would like to become the superior platform for qualified signing processes in Europe. "We have developed a platform that can grow with our customers, from small law firms to internationally operating corporations. The QES interface also helps us reach our next milestone: From now on, we want to open up new markets and, in addition to further expansion in Germany and Austria, also target selected countries in Central and Eastern Europe as well as the Baltic States," adds Fabian Knirsch, CTO and Co-Founder of sproof.

More blog entries

Hendrickson: The locations in France and Austria are digitizing their signature processesCreating a digital signature - How to obtain a (qualified) electronic signature (QES)Private banking in transition - Bank Gutmann relies on digital signature"sproof 2.0" is ready for you nowWhat is the qualified electronic signature in Europe (Update 2024)